Charity Accounts Production software with efficiency-boosting integrations with bookkeeping packages and straightforward Tax Returns.

Charity Compliance

for Accounts Production and Tax

Our Charity Accounts Production and Tax Return software provides an affordable, easy-to-use solution for Charitable Companies.

The FRS 102 SORP template for our Accounts Production module creates a time-saving compliance process. It provides a quick way for charities and their accountants to generate the set of accounts, then easily create the Corporation Tax computation for schedule CT600E for simple year-end charity compliance.

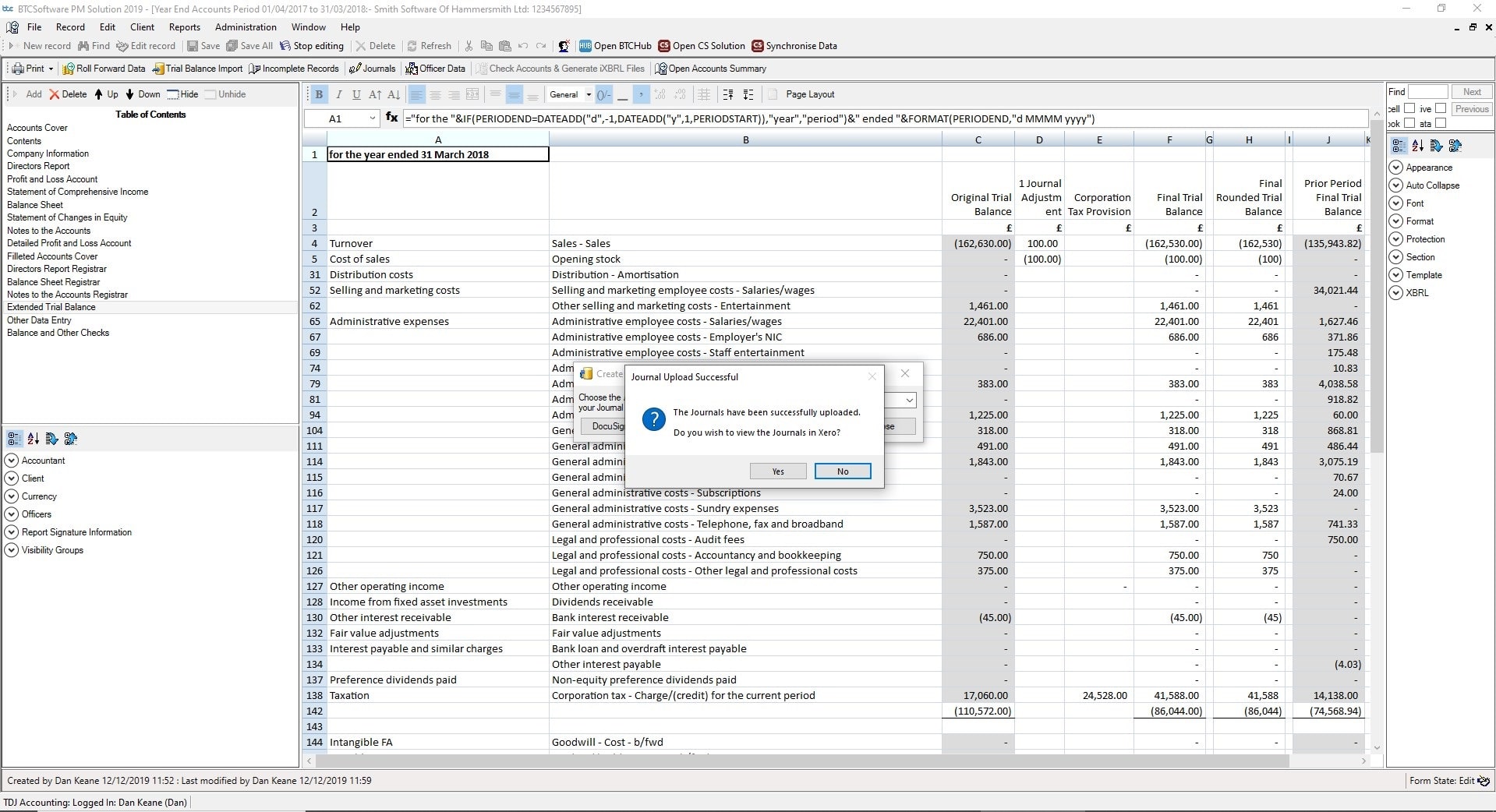

We create efficiency through links with many bookkeeping products (including online bookkeeping software like Xero, Quickbooks, Reckon One, Clear Books, FreeAgent, Iris, KashFlow, Sage and VT). Charity software makes it easy to comply with the reporting requirements of company law and the requirements of the Statement of Recommended Practice published by the Charity Commission.

Easy reporting

with seamless SORP compliance

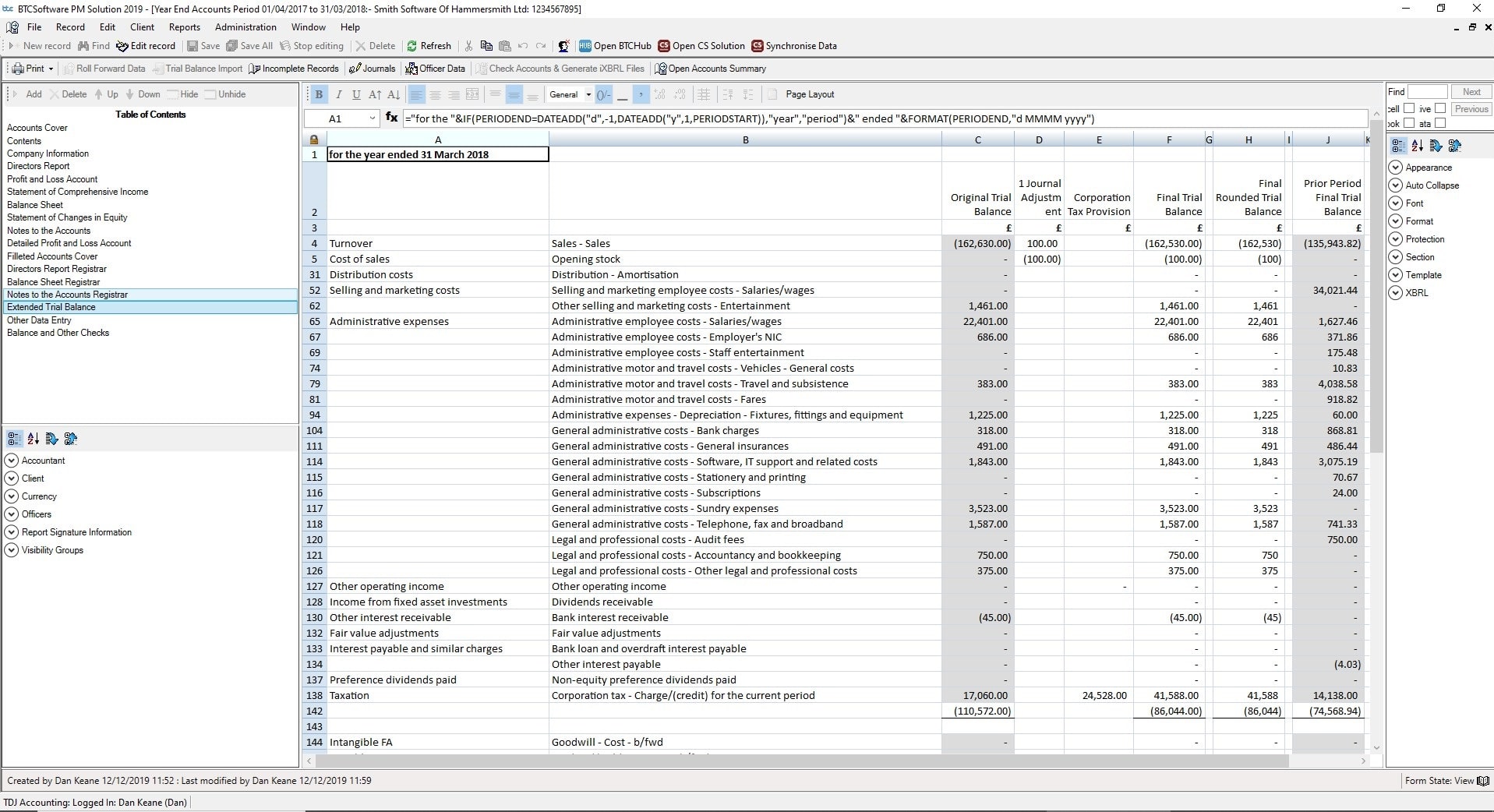

The Charity Accounts FRS 102 template makes it easy for charitable companies to meet their disclosure requirements. It’s intuitive and straightforward to use and is driven by entries in the extended trial balance which directly links with many major bookkeeping software to give you the integration you need. Charities have the ability to detail the names and purposes of different funds, then create a formatted set of accounts and corporation tax return, ready to send.

Charity Accounts

Key Features

Affordable compliance for charities

FRS 102 Accounts Production software for charities to meet the disclosure requirements of the Charities SORP

Full compliance as required by the Charity Commission

Charity accounts and corporation tax returns as required by the Charity Commission and HMRC for stress-free compliance

Accurate and fast data input

Using screens designed to be intuitive and validation of entries

Time-saving integrated software

One-stop solution to create returns for charities when linked to Practice Management Core.

Your data in one place

Speedy pre-population of key charity data from PM Core – including Officers’ details, registration numbers, Registered Office, Accounting Period, etc.

Easy formatting for Companies House

Prepare annual accounts for Companies House without leaving the software

Link with Charity Corporation Tax

Easily use data from the charity’s set of accounts to complete the Corporation Tax computation, then use schedule CT600E for Charity Tax Returns.

No additional charges

Telephone and email support included in your licence and no additional charges for updates in line with policy changes

Easy to install and

unlimited free technical support

We support you with:

- Simple install pack for network or standalone installations

- Cloud installation via our technical team

- Useful quick start videos

- Simple transfer of standing data

- Ongoing technical support by phone or email