The fact that digitalisation is the future is unavoidable, but as the deadline for small businesses to join MTD for VAT approaches, you may find yourself back in a position of justifying why your clients with the least resources should embrace the inevitable.

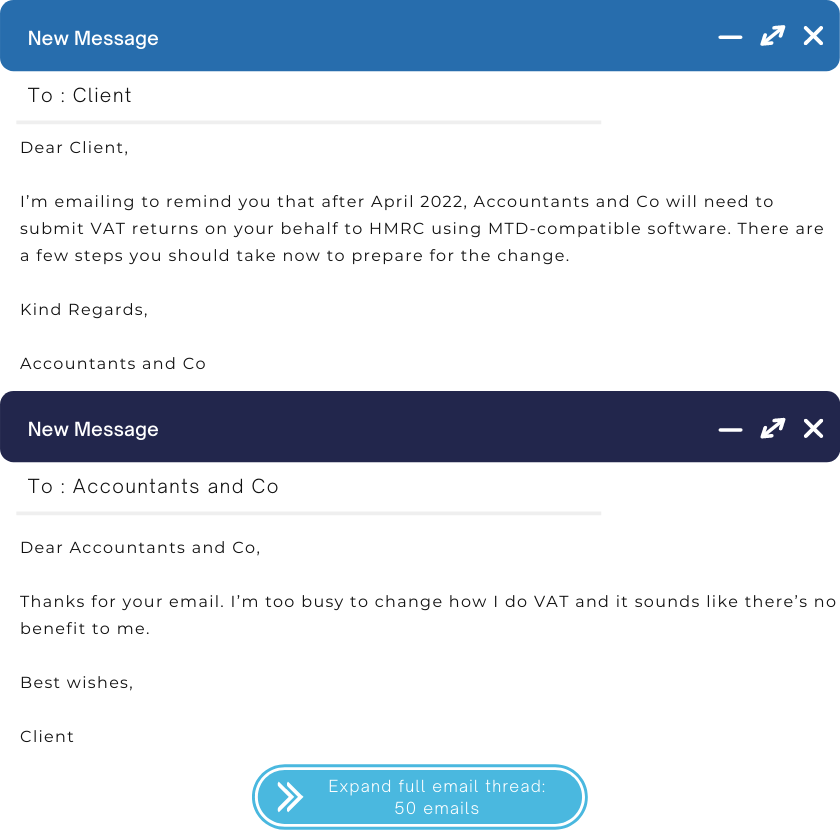

As an accountant, you need to be ready to equip your clients with the knowledge they need to get started. Preparing your clients can feel like a full-time job at times but starting early will make the process much easier. We have used our experience of helping our customers with phase one of MTD to bring you a definitive five-step process to help you help your small business clients.

MTD for VAT – a quick recap!

HMRC’s agenda for the MTD transformation was to make administration more effective, streamlined and reduce potential errors for taxpayers. By creating a digital link between records and returns, the aim is to reduce the £9bn lost to avoidable errors each year.

In July 2020, the government announced that Making Tax Digital for VAT would become mandatory for businesses below the VAT threshold (currently £85,000) from April 2022

2020 boosts digitalisation

The impact of the pandemic on the speed of digitalisation has been dramatic, with a survey from McKinsey and Co reporting that “respondents are three times likelier now than before the crisis to say that at least 80 per cent of their customer interactions are digital in nature.”

Step 1 – Anticipate key dates

Critical dates have a nasty tendency to sneak up on busy accountants, but preparing small business clients to switch to MTD for VAT can reduce the stress of last-minute panic.

We’ve created a helpful Making Tax Digital graphic for you to download and share with your clients. Get it here.

In phase one of MTD, we helped practices migrate their clients to the new process by designing our software to accept digital records from multiple sources. Bringing small businesses on board has the potential to include difficult conversations about upgrading bookkeeping software, but there’s an easier way. BTCHub allows you to import figures from bookkeeping and even Excel spreadsheets.

Step 2 – Attend webinars and keep up to date with HMRC news.

Follow relevant social channels such as BTCSoftware (we’re on Twitter!) to keep track of important news updates so you are equipped with the knowledge to pass on. There’s also plenty of information on HMRC, so bookmark these two pages if you haven’t already:

HMRC Videos, Webinars and Email Alerts

Webinars

Gain valuable insight from software companies like BTCSoftware who have knowledge and experience in the area and host many webinars. Be sure to ask questions during the webinar, too; on a previous ICAEW webinar, we were able to answer our viewers’ pressing questions with the help of our CFO Ian Katté. It also allows you to ask questions where you may not have been able to find the answer and enables you to have a dialogue with an industry expert. Check out the webinars previously hosted by BTCSoftware.

Step 3: Educate your clients about the benefits so they can embrace the change

Many small businesses have been using Excel spreadsheets to keep records for years, and HMRC has confirmed that spreadsheets remain a compliant method of digital record-keeping under MTD rules, so don’t fight a battle unnecessarily and embrace bridging software.

When contacting your clients, lead with the value of MTD and reassure them that – for the most part – nothing will change for them if they engage you for VAT services. Illustrating other perks to your clients can also make them less anxious such as:

- Being digital will future-proof your bookkeeping processes to ensure more reliable data is being captured and saved

- They can see real-time information about their business to make quick and confident decisions

- Many bookkeeping options can be installed across multiple devices to save time – even Excel has an app now!

Step 4 -Training

In an ideal world, you’d have time to approach every client and provide in-depth training on best practices for MTD. To make things simpler and faster, consider running a classroom session for all of your small business clients where you present the information and invite them to ask questions.

You can also make use of resources online, like our downloadable MTD infographic, or share YouTube videos explaining the changes which they need to be aware of.

Step 5: Learn from others

If your clients are struggling to understand the benefit of digital VAT, take a look at countries that have already gone digital.

Here are a few examples you could share:

A warning story from Mexico

In October 2016, the Mexican tax authority reported that it had performed approximately 11,000 electronic audits and levied 5,358 fines totalling MXN 55.8m, resulting in the closure of 565 establishments due to non-compliance (source: accountancy daily).

A success story from The Czech Republic

The Czech Republic’s decision to move to digital VAT reporting was prompted by the country having one of the highest rates of VAT fraud in the EU, with a Kč64bn (£2.2bn) VAT gap in 2014. From that year, businesses have been required to file VAT returns online via state-provided data boxes called NEN, secure processing centres for communicating with the government (source: accountancy daily)

A reason from Italy

The creation of the Italian digital system was prompted by the fact that Italy’s VAT gap is the largest in the EU, accounting for 23% of an estimated €151.5bn VAT missing (source: accountancy daily)

All three countries provide different reasons for your clients to pay attention to Making Tax Digital.

Source: https://www.accountancydaily.co/mtd-examples-around-world

MTD is the future for small businesses

Change can be worrying for some of your clients; however, setting the groundwork for an easy move will build trust in your practice’s capabilities.

Some small businesses may encounter some challenges along the way, such as cost, but starting earlier and exploring options alongside your clients will allow you time to get it right before penalties are introduced.

BTCSoftware provides affordable software options for small business needs and customer care to help them along the way. We’ve got plenty of demos to watch to help you understand how BTCSoftware can work for you, or book a personal demo with one of our experts here.