This year, we ran our biggest ever survey of accountants. The data shows the rise of young millennials in accounting.

In 2017, Forbes reported that 72% of millennials believe that “start-ups and entrepreneurs are a necessary economic force for creating jobs and driving innovation”. Two years later, Accounting Insight News found millennials leading 38% of UK small businesses. Time Magazine got it very wrong when they called this generation “lazy” and “entitled” back in 2013.

Young millennials in accounting

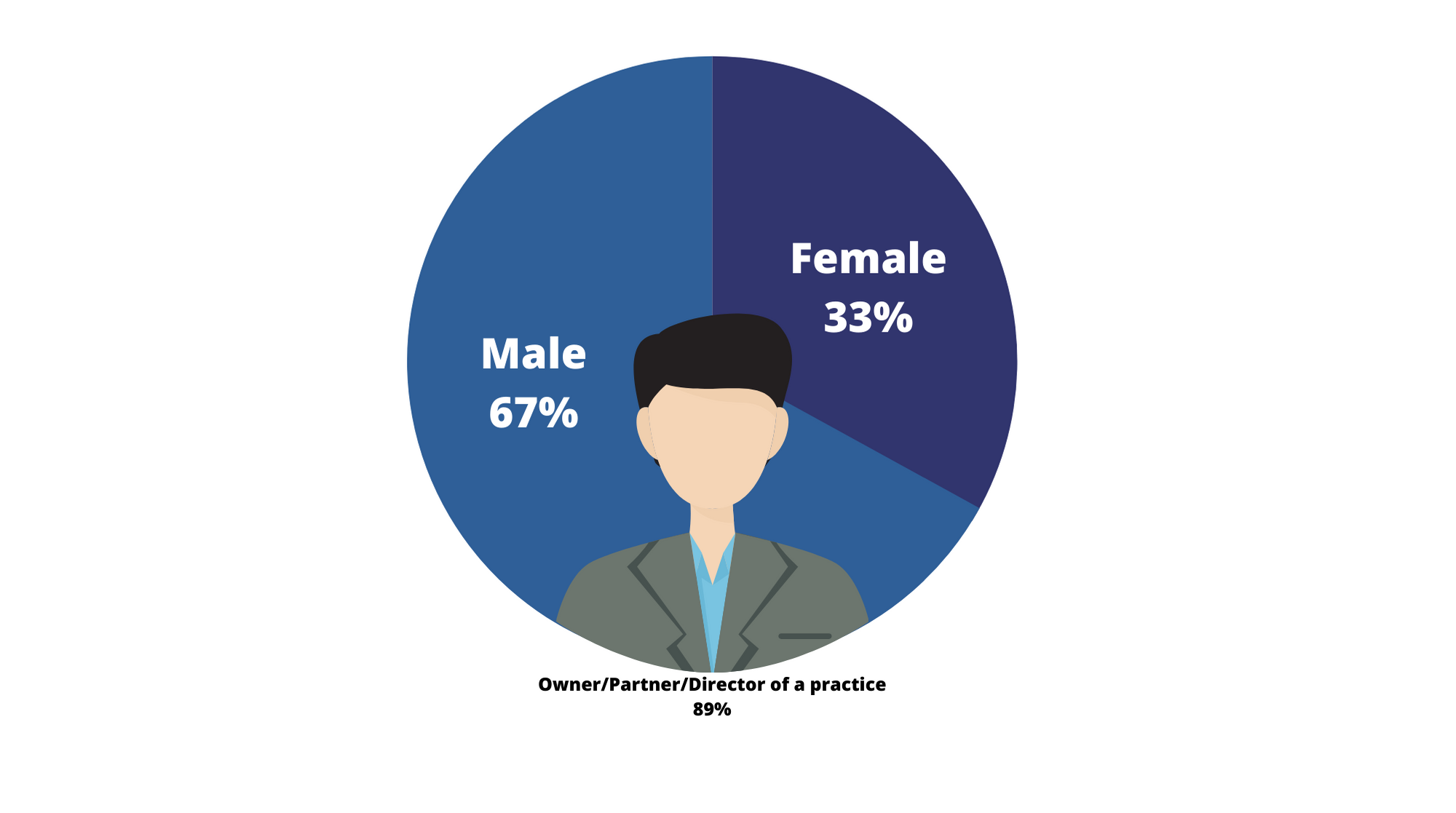

In the 2020 survey, millennials in accounting were recorded as 24 to 34 year olds. 89% of the young millennials surveyed are owners, partners or directors of their practice. Just 33% are female, however. In older generations, the split is close to 50/50.

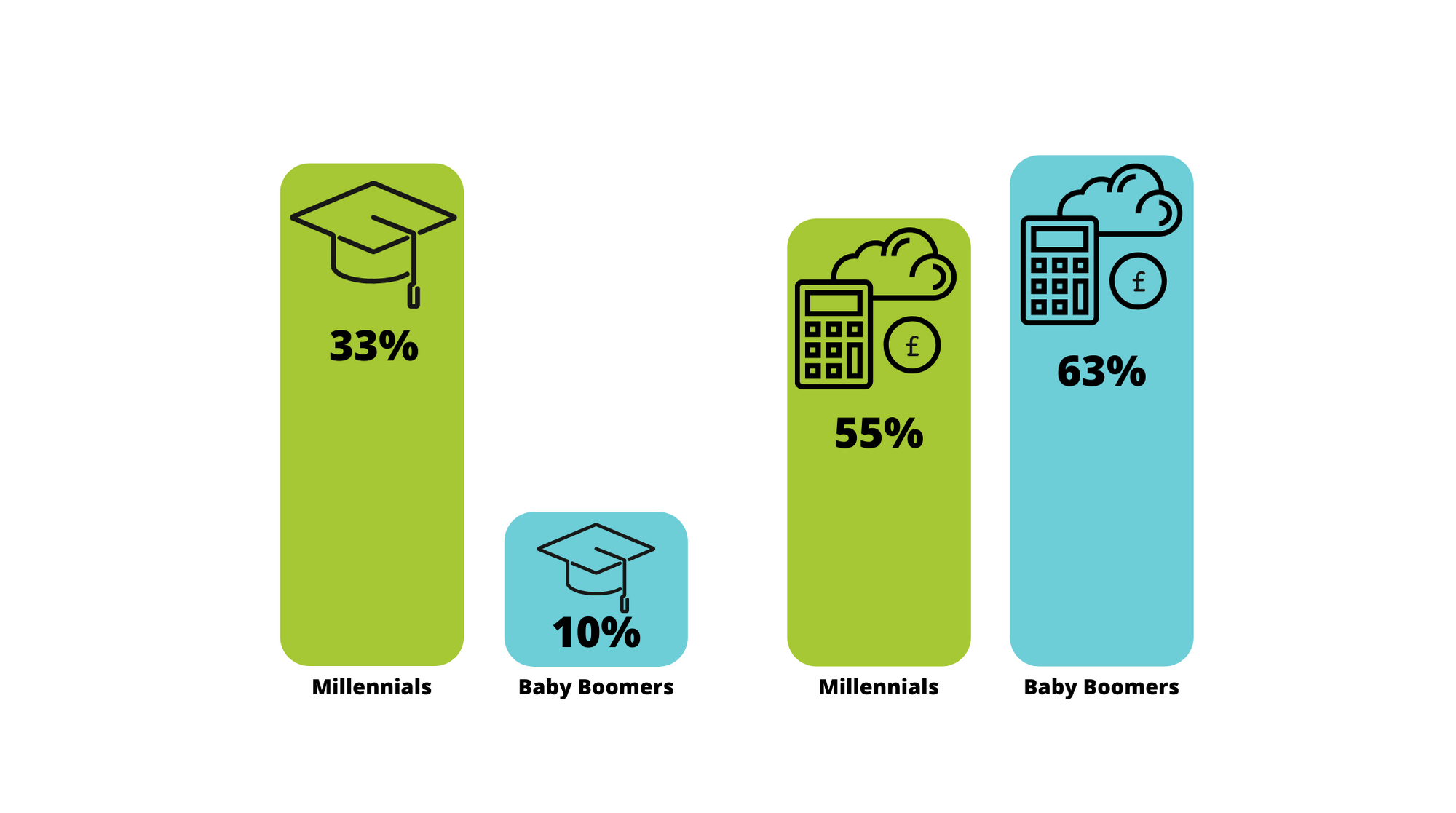

More millennial practice leaders completed an accounting degree than their older peers. Across all age groups, most gained their qualifications through an industry body. The most common were AAT, CIMA and ACCA.

Although young millennials favour ACCA and AAT as their industry bodies, a huge 55% rely on ICAEW for tax information. That makes ICAEW the go-to source for their news and updates.

We asked: how could accountancy education be improved?

The responses to this question from younger millennials said that better practical education is an improvement they’d like to see. On-the-job experience is considered as valuable as exams and technical understanding. One reply in this age group perfectly summarised the majority of answers:

”“By focusing more on the real-world scenarios, giving a flavour of how to use the software etc, I feel there should be one separate exam just purely on Fintech and the accountancy and tax-related technology, apps and its ecosystems.”

Digitalisation for the generation that grew up with the internet

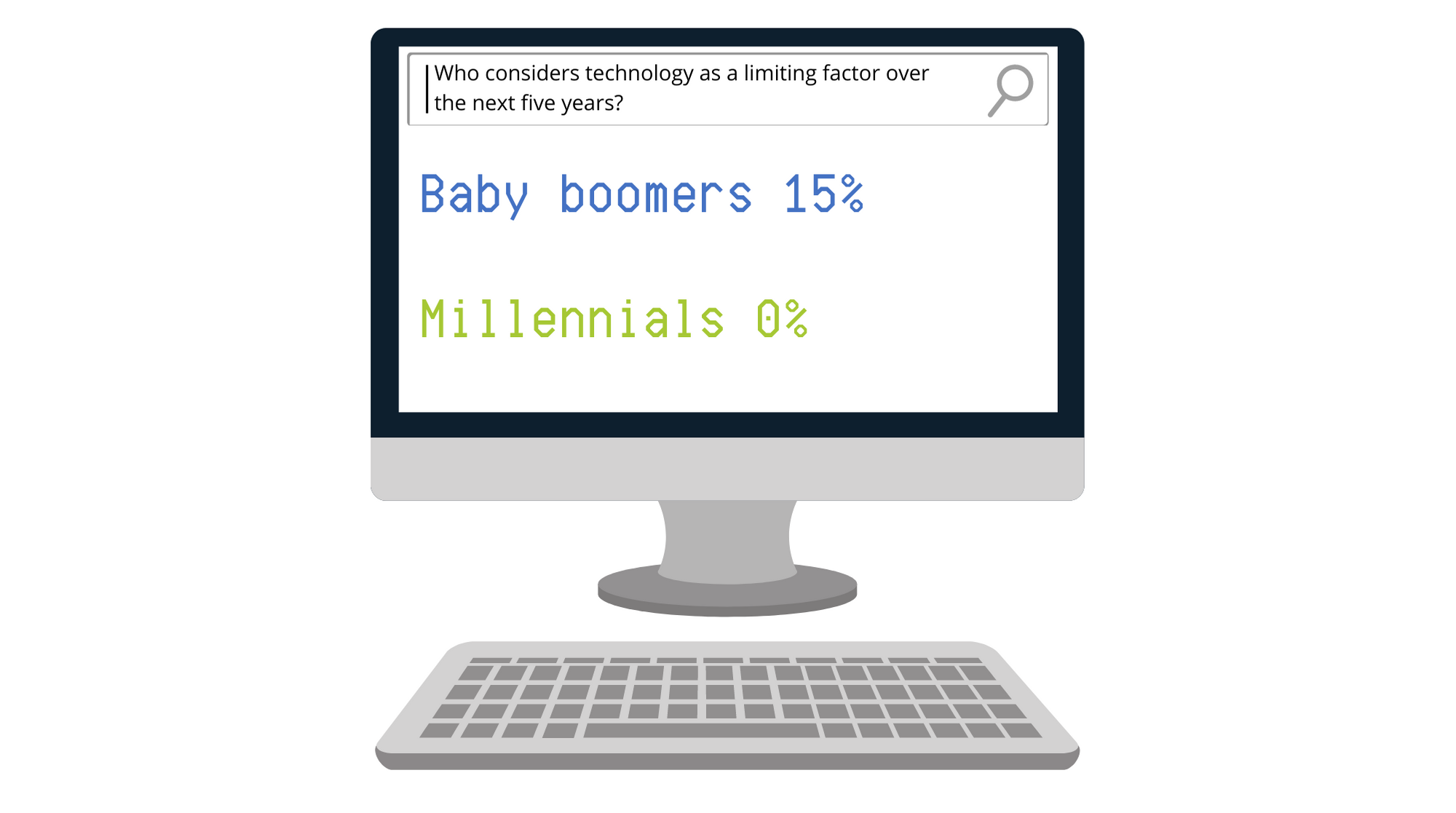

HMRC’s plans for Making Tax Digital are a concern across all age groups. Around a third of replies cited HMRC changes as their most significant limitation in the next five years. However, no respondents in the young millennial demographic indicated that they felt software or remote working would limit them. That figure jumps to 15% for both baby boomers and gen X.

We asked: how do you view the future of tax and accounting?

Many replies to this survey question from millennials were framed with positive language featuring words like “exciting” and “bright”. They also feel that automation will lift the pressure of compliance work and allow their practices to focus on advisory work.

Our survey shows all accountants are superstars – not just young millennials

One thing that accountants in all age brackets have in common is their dedication to their clients. Over three-quarters of all respondents told us that they help their clients adapt to new market conditions, and half said they did not charge extra this year due to the pandemic. Another 28% reported that they charge on an ad-hoc basis depending on complexity, time spent and the extent of their involvement.