Knowledge Base Articles

Super Deductions

FAQs » Pre Sales FAQs » Super Deductions

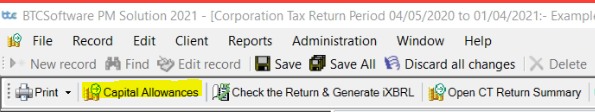

In order to get the Super deduction on a corporation tax return you’ll need to go into the Capital allowance calculator. You can access this by clicking on the Capital allowances button in the top left-hand corner of the screen (see below):

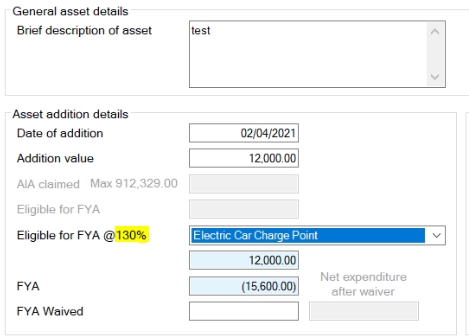

From here edit the Main Pool, and add a new asset. Tick the Asset addition tick box and then enter a relevant date that coincides with the Super deduction date requirements. Then enter your addition value.

Then from the Eligible for FYA drop down menu, select a relevant item. The software will then look at the Date of addition and the Eligible for FYA drop down field and if it coincides with HMRC’s guidelines you’ll see the percentage change from 100% to 130% (see below):

Please also bear in mind, not all items in that drop down are eligible for the Super deduction.