Accountants who support charity clients understand that the challenges facing the sector at the moment are monumental. With costs of living increasing and inflation at its highest level since 1982 according to the ONS, charities need support from accountants who understand that easy routes to financial compliance and smart planning based on data go hand-in-hand.

Challenge: Charity clients often have limited resources

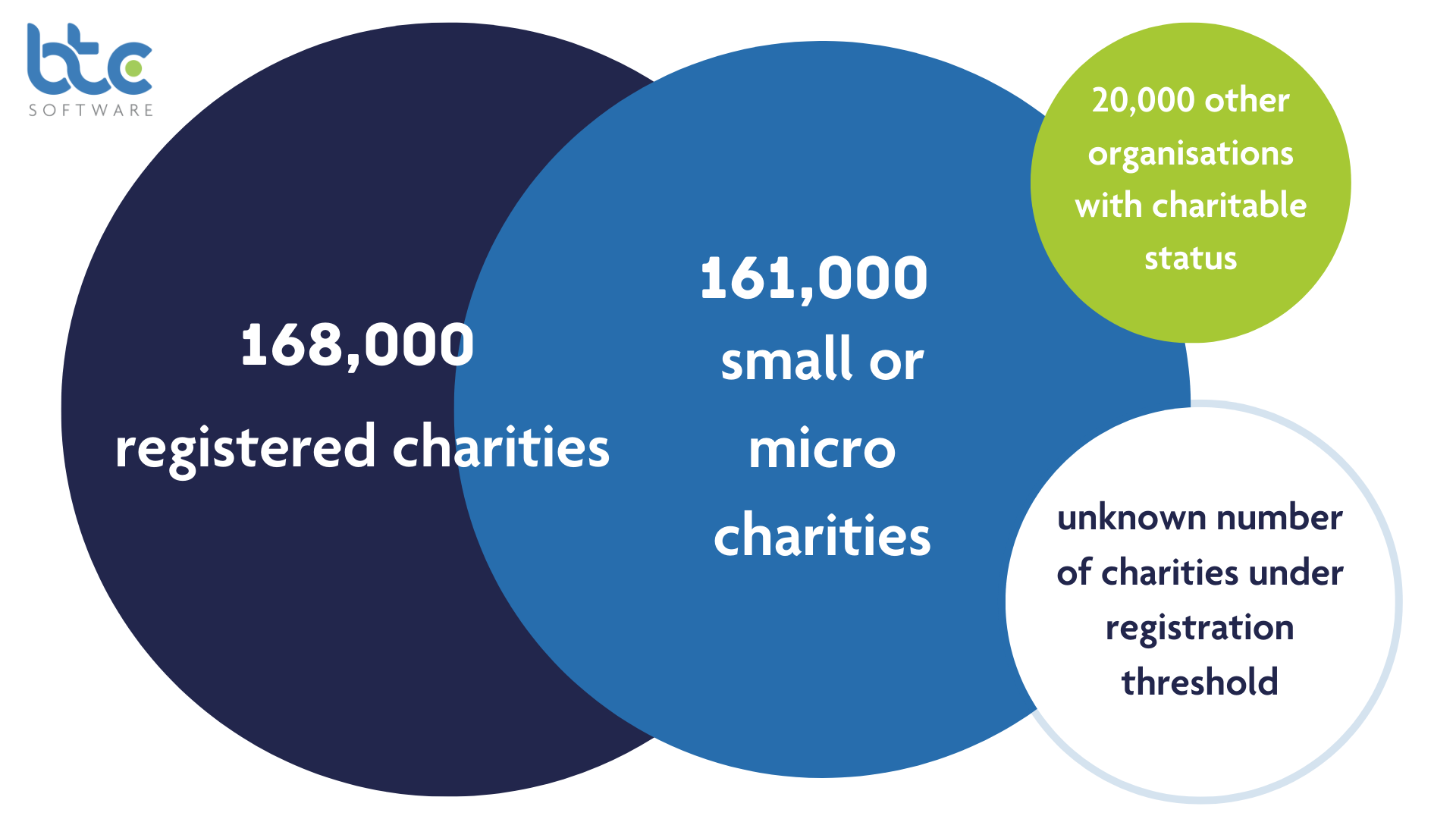

There are around 168,000 charities registered with the Charity Commission in the UK. Of those, a massive 96% are small or micro charities, with income below £1m. There are a further 20,000 other organisations with charitable status such as schools and churches, plus an unknown number of charities with turnover below the registration threshold of £5,000 annual income.

All of this, plus the other challenges below, indicate that accountants are well placed to support their charity clients when it comes to compliance with Charity Commission rules. From filing accounts for charitable companies to Companies House to preparing returns to reclaim VAT, your support is invaluable when resources are limited.

Be aware of other challenges facing charities in the UK

Alongside their financial priorities, charities are also concerned with their role in society, with 91% agreeing that the sector will be expected to fill the gaps in public service provision. And on top of that, only 24% say they have the knowledge to raise funds online, which is a significant challenge for many since the shift to cashless transactions during the pandemic.

Your role as an accountant looking after charity clients

As an accountant, you have a wealth of knowledge that can support your charity clients. You can make a difference by taking the strain of compliance from them – you handle the deadlines and the paperwork. When charity clients come to you for their accounting work, you need to be able to help them using the right tools at the right price.

Using BTCSoftware means that you can easily stay on top (PM deadlines) of work, process data efficiently (import and integrations) and accurately (trial balance mapping), without breaking the bank. Take a look at our module and pricing page here.

See it in action

Get in touch on 0345 241 5030 or drop us a demo request online.