HMRC’s end of August report on the SEISS has been released, and the figures make for interesting reading.

The SEISS was introduced to support self-employed individuals who have been adversely affected by the Coronavirus pandemic. It was also open to members of a partnership.

HMRC has assessed eligibility by looking at the 2018/19 self-assessment tax return. Trading profits must not exceed £50,000 and be at least equal to non—trading income. If eligibility cannot be established based on 2018/19, then HMRC looks at tax years 2016/17, 2017/18, and 2018/19.

The initial grant was equal to 80% of an individual’s average monthly trading profits, capped at £7,500 total, and paid as one installment to cover three months of profits.

A second and final grant is now available, worth 70% of average monthly trading profits, and capped at £6,570 to cover three months of profits.

The stats

To be assessed the self-employed individual must have traded in 2018/19 and have submitted a Self-Assessment tax return on or before 23rd April 2020 for that year. Eligibility for SEISS requires levels of income that meet tests based on an individual’s income in 2018/19 or a combination of the consecutive tax years since 2016/17.

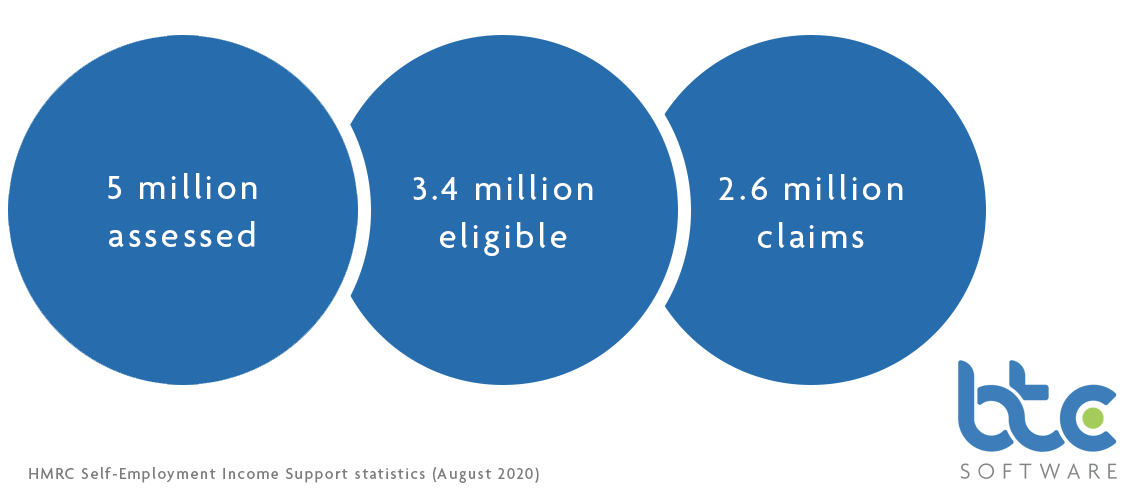

About 5 million were assessed for eligibility for the SEISS based on their reported self-employment income for 2018/19. 3.4 million were considered eligible. By 31st July 2020, 2.6 million had claimed, with the value totaling £7.6 billion. The average claim value is £2,900.

Some considered eligible will not have been adversely affected and some will have ceased trading.

Among the 1.8 million individuals assessed to be ineligible, 88% had a trading profit below their non-trading income, 33% had a trading profit below £0, 11% had a trading profit over the £50,000 threshold and 2% were for other reasons.

For the full breakdown of statistics, you can access the report on the gov.uk website.

Self-Assessment Tax Returns 2020/21

With many accountants starting to prepare their practices and clients for January 2021, now is the time to get to grips with how the SEISS will affect individual tax returns.

The SEISS is a taxable grant and therefore will be declared on the 2020/21 tax return. Additionally, any deferral of the second payment on account for 2019/20 will fall due on 31st January. Accountants will need to help their clients plan for any additional payments due.

We’ll be releasing our guide to Self-Assessment very soon – follow us on LinkedIn to get your copy!

Ready to talk?

If you’re thinking about making Self-Assessment easier on your practice, why not take a look at our award-winning SA Solution. It makes compliance work simple, giving you time to focus on supporting your clients and adding value to your services.

The best way to start is with a free remote demo. You can get in touch on 0345 241 5030 to chat about your needs, or book here.