Award-winning and reliable Corporation Tax software for quick and easy calculations and CT600 submissions. Manage Corporate Tax Returns with our Intuitive Corporation Tax Solution.

Software Designed for Accountants

Simple and straightforward UK Corporation Tax

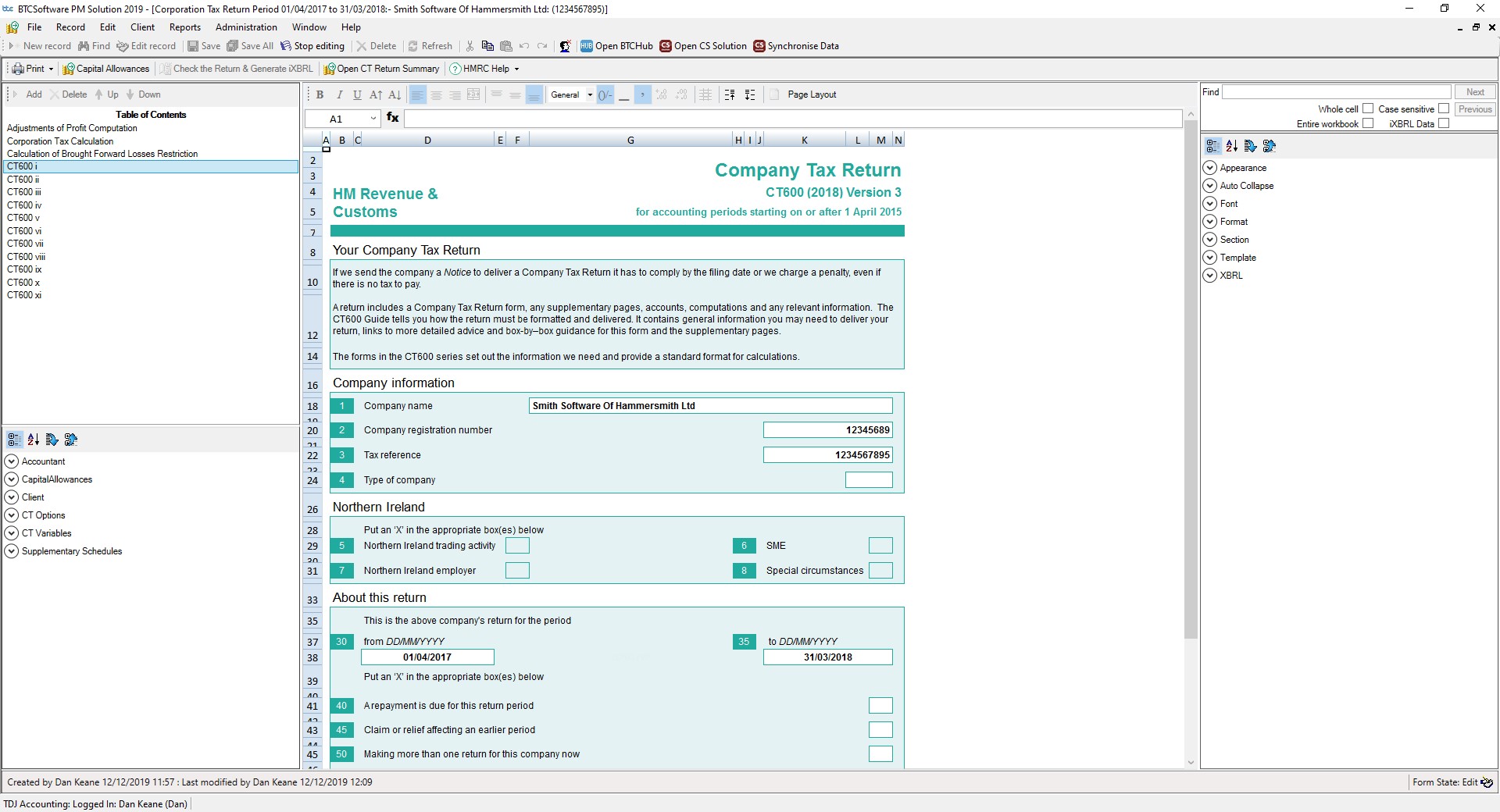

Our award-winning Corporation Tax software has been designed to save time for accountants in practice, as well as accounting and finance professionals in business. This intuitive tax software is easy to use for everyone and allows UK accountants to easily complete submissions of CT600 for HMRC. It includes automatic iXBRL computations and iXBRL tagging that’s compliant with HMRC.

Never miss a corporate tax deadline

BTCSoftware customers say this CT600 tax software for preparing Schedule D Case 1 computations saves them time. You can manage compliance for trading companies and calculate the resulting Corp Tax liability using links to our Accounts Production module. Corporation Tax is driven by data from Practice Management Core Software to keep you on track.

Simple & Easy to use Software

HMRC-compliant Corporation Tax software makes your work simple

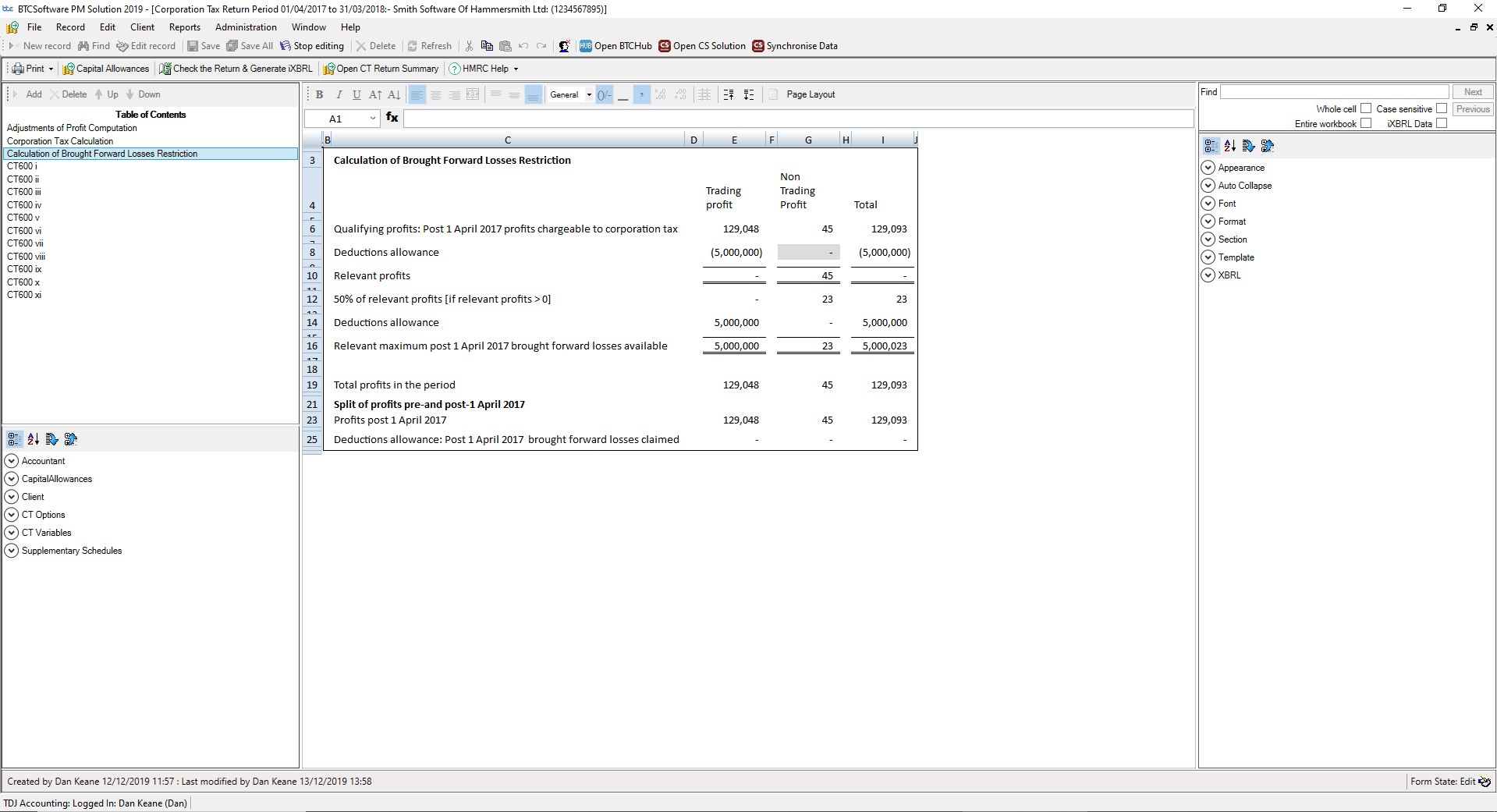

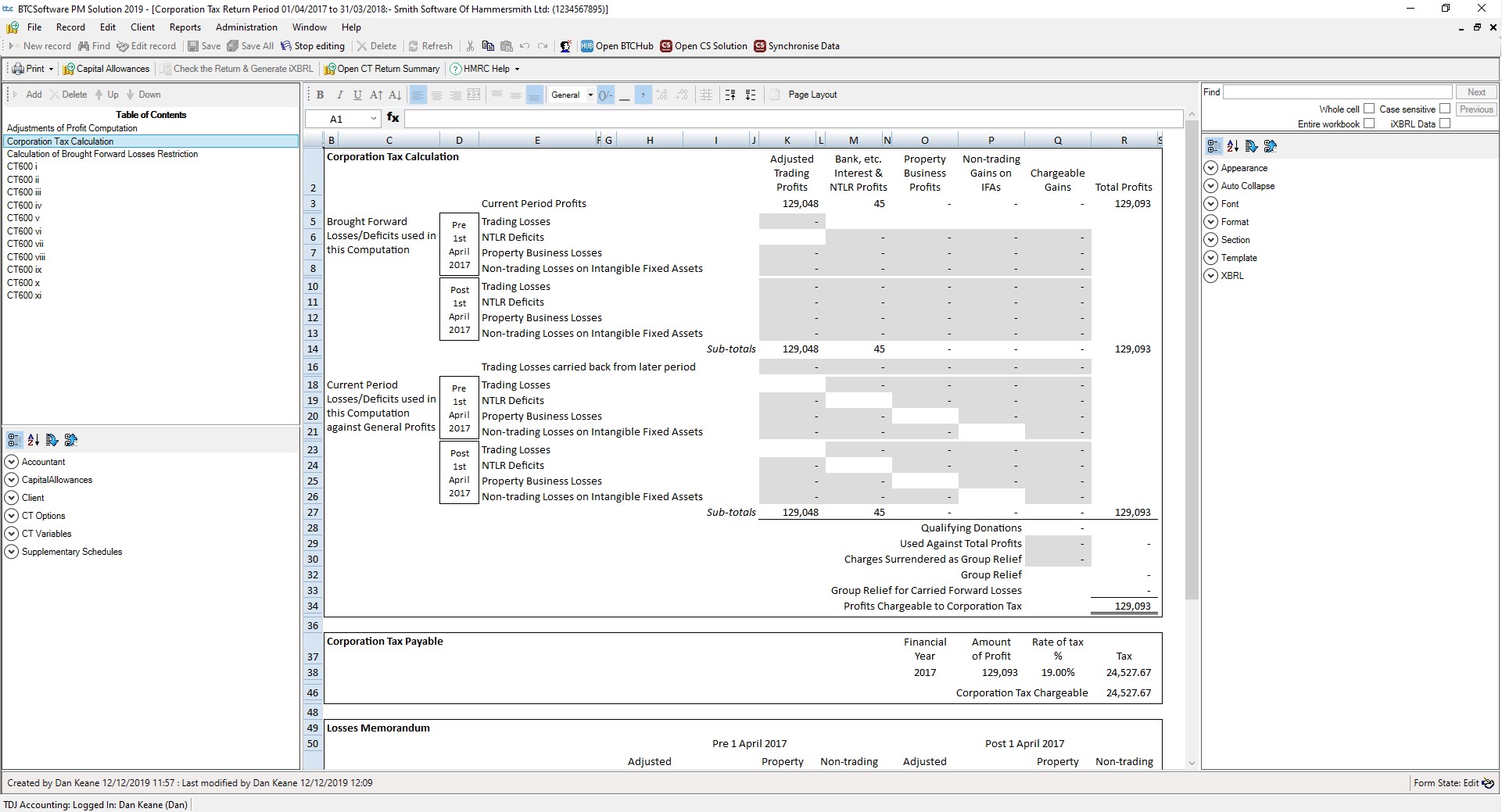

Corporation Tax is accelerated using our adjustment of profits computation which features built-in capital allowances calculations and quickly calculates the corp tax due. Our Corporate Tax software is all presented on a single, easy-to-use worksheet. Results are automatically transferred to the HMRC-approved substitute CT600 form for online submission directly through the Government Gateway.

Easy integration

Our Corporation Tax software integrates seamlessly with our Practice Management Software and Accounts Production software products. It enables accounting and finance professionals to be more effective in their accountancy and tax compliance work.

Corporation Tax Software Key Features

Company Tax Return supplementary pages

The Corp Tax forms you need in one place with CT600A, CT600C, CT600D, CT600J & CT600K

CT600 Software for your tax returns

CT600 supplementary schedules included for Research and Development, Loans to Participators, Group and Consortium, Insurance, Amateur Sports Clubs (CASCs), Disclosure of tax avoidance schemes, Restitution Tax

Key data in one place

Fast and accurate pre-population of data from PM Core giving you essential management tools for your practice and reducing the risk of errors

HMRC Compliant Software

Fully HMRC compliant iXBRL computation, tagging and CT600 submissions

Easy to input company tax data

Easy data input using familiar screens and dialogues and added-value from onscreen prompts to guide you through the recognised, HMRC-approved corp tax software layout

Two-way links to Accounts Production

Full two-way integration with annual accounts to make year-end accounts production simple for accountants

Quickly calculate Capital Allowances

Comprehensive Capital Allowances module with time-saving automatic calculations

The specialist tax forms you need

A dedicated property and research and development module, short and long forms, and add-on Charitable Companies

Easy to install &

free unlimited technical support

Our Corporation Tax return software is simple to install for network or standalone installations or choose our cloud-based option for added flexibility and security.

- Simple installation process

- Easy-to-follow user guide

- Unlimited technical support when you need it

- Quick transfer of initial standing data

- Regular updates in line with HMRC